8 Best online Money Saving Applications Of 2022

As previously discussed, to manage personal finances is

to invest. This investment can be your guide to saving money properly.

Moreover, you can get dividends which can be passive income.

But this investment should not be careless, you must

learn about investment instruments, the risks faced and so on. Apart from

investing, you are also advised to save.

Because saving can help you if at any time you need

emergency funds or unexpected funds.

Well, this is just right! This time we will recommend the

most trusted and newest online savings application. So, listen carefully, OK?

Online Savings Application

1. SeaBank

2. Genius

3. Neobank

4. LINE Bank

5. Bank Jago

6. Blu by BCA Digital

7. Digibank

8. My pal

9. IPOTPay

10. PermataMe

Want to Save? Try this Trusted Online Savings

Application!

Instead of borrowing money in an online loan application,

it's better for you to just save up to buy something you want in one of the

following online saving applications!

1. SeaBank

The first reliable online savings application is SeaBank.

This application is one of the digital services owned by PT Bank Seabank

Indonesia, where the company is a part of the Sea Group.

For those who don't know, Sea Group is the parent company

of the online selling site, Shopee. You can use this application as a place to

save online. Even every day you get interest.

The interest you get is disbursed every day and you can

transfer between banks for free or without admin fees. So it's not surprising,

if this application is highly recommended.

2. Genius

The next trusted online savings application is Jenius.

This application is an application from the bank BTPN. In fact, this

application is one of the pioneers of digital bank applications where you can

save online.

Not just for saving, you can also use this application

for digital transactions such as subscribing to an application. For example,

subscribing to a movie streaming app like Netflix.

3. Neobank

The next trusted online savings application is Neobank.

As you know, the Neobank application is a money-making application, where by

inviting friends to register and using a referral code, you will get a

commission.

You can save the commission that you get in the

application. Not only that, you can also save money online in this application.

Because the interest you get every month is quite high.

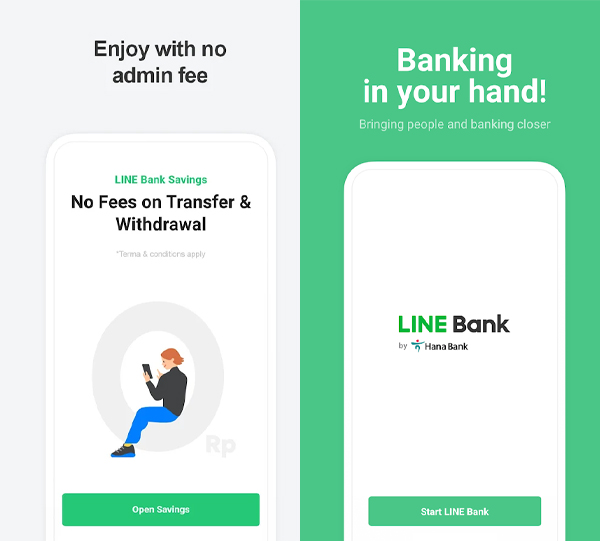

4. LINE Bank

The next newest online savings application is LINE Bank.

Yups, for those of you who are guessing, this application is indeed one of the

applications that comes from the most popular chat application, namely LINE.

Where you can use this application for transactions and

you can directly transact via the LINE application as well. Interestingly, you

can also save money online through the application. Savings can also be in the

form of time deposits!

5. Bank Jago

The next newest online savings application is Bank Jago.

Previously, this application was known as Bank Artos (PT Bank ArtosTbk), where this application functions to make managing finances easier,

because it can be done online.

So you can save through this application. Not only that,

you can also send money easily to other banks. So it's not surprising that the

Bank Jago application is also one of the inter-bank money transfer

applications.

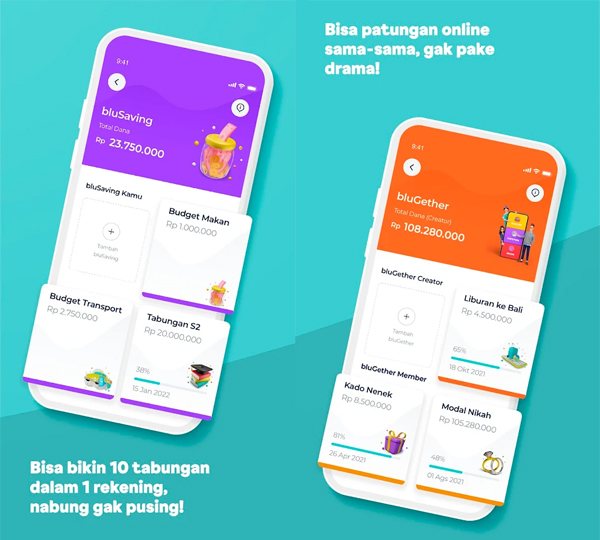

6. Blu by BCA Digital

The next newest and most trusted online savings application is Blu by BCA Digital. This application is one of the applications created by the largest private bank in Indonesia, namely BCA. Where you can use this application to save money.

This application has many functions, one of which is to

save education funds, travel savings or long-term savings and so on. So, for

those of you who want to save, you can really use this application.

7. Digibank

The next newest and most trusted online savings application is Digibank. This application is one of the applications created by PT Bank DBS Indonesia. You can use this application for those of you who want to open a savings account online.

Not only that, you can also save deposits and invest.

Interestingly, this application has many special offers such as attractive

promos for those of you who like to shop online in online shop applications.

8. My pal

The next online savings application is My Friends. This

one application is very well known among MSMEs because it is a savings and loan

cooperative service. This application is also supported by Bank Sahabat

Sampoerna.

So, for those of you who want to save money, you can

really do it through this applicationbecause the interest earned is quite

large. In addition, this application is not subject to admin fees. So you can

be more economical.

9. IPOTPay

The next online savings application is IPOTPay. This one

application is an application published by PT Indopremier Sekuritas, where this

company also publishes online investment applications.

So, the difference is that IPOTPay is intended for anyone

who wants to save online easily. Moreover, in this application there are no

administration fees and you can use it to pay bills and so on.

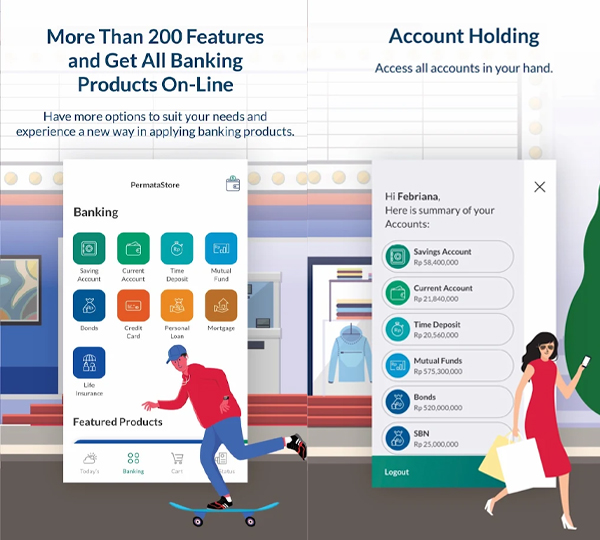

10. PermataMe

The last online savings application is PermataMe. For this one application is an application made by PT Bank Permata. Where can you use it to save money online.

Moreover, this application is one of the online selling

applications, because to transfer money online you will not be charged

additional service fees and admin fees for transfers. So it will save you more,

guys?

So, those are some recommendations for trusted online

savings applications on Android and iPhone. So, which online savings

application do you want to install? If so, don't forget to write it in the

comments column below, guys 🙂

Other

Interesting Articles!

- 7+ Ways to Manage Finances with a Salary of 2 Million So It's Enough!

- 5 Most Risky Jobs with Lustful Salaries

- 8 Ways to Manage Household Finances with a Salary of 3 Million

- 8 Ways to Manage Household Finances with a Salary of 2 Million

- 8 Ways to Manage Household Finances with a Salary of 1 Million